With a large number of cable replacements available, there’s no reason to have a contract or pay $200+ per month.

#Common monthly expenses free

*Related: Want to cut the cord but don’t know which platform to pick? Take our free quiz to learn which streaming service is best for you. If Sling isn’t for you, there are many alternatives that let you have the feel of cable while saving each month.

#Common monthly expenses tv

Our Sling TV channels list guide shows all the channels you receive as well as other benefits the platform offers.

Secure a low rate on loans and kill debt. The savings might be higher if you currently make the minimum monthly payment to your credit card. Potential monthly savings: At least $15 (if you reduce your interest rate by two percent and can pay off a $7,200 balance in five years). If you’re struggling with debt, consolidation may be one of the best ways to pay it off once and for all. There are many other ways to lower your interest rate and pay off debt. This may help you save money on interest and kill debt faster. The lender has no required fees and has rates as low as 8.99 percent. SoFi is a terrific platform that can help you lower your interest rates. This way you only have one monthly payment. To simplify your credit card debt payoff strategy, you can consolidate your balances. If you have balances on multiple cards, it can be challenging to keep track of all your monthly payments and interest rates. This is especially the case in a rising interest rate climate. Due to high interest rates, it can be difficult to eliminate credit card debt quickly.

household carries approximately $7,200 in credit card debt. Here are the best ways to lower your monthly expenses and save money. It is possible to negotiate lower rates or cancel services. Many people believe it is difficult or impossible to reduce expenses. Fortunately, that is not the case.

#Common monthly expenses how to

How to Lower Monthly Bills and Save Money Start with $100, and electronically deposit at least $200 a month to earn this rate! All deposits are FDIC insured up to the $250,000 per depositor maximum. *Deal of the day: Earn 4.50 percent (12x the current national average) on your cash with CIT Bank’s Savings Connect account.

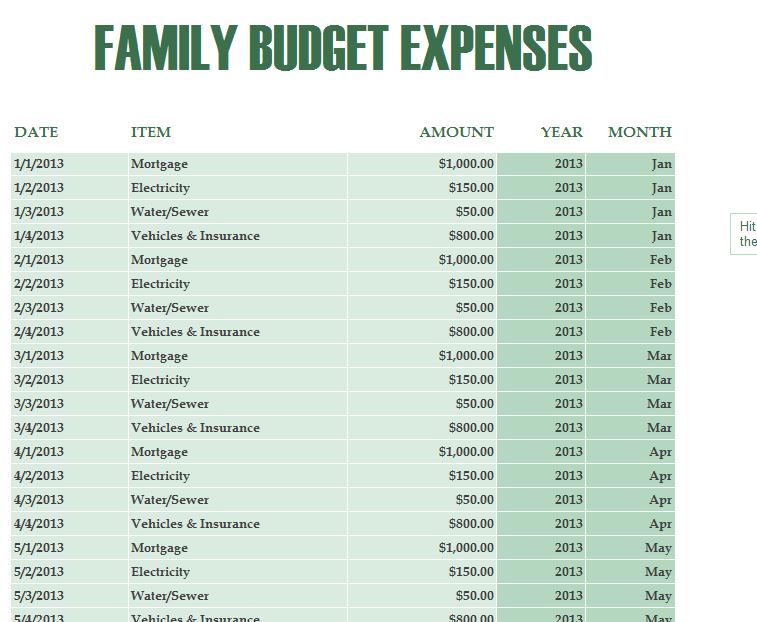

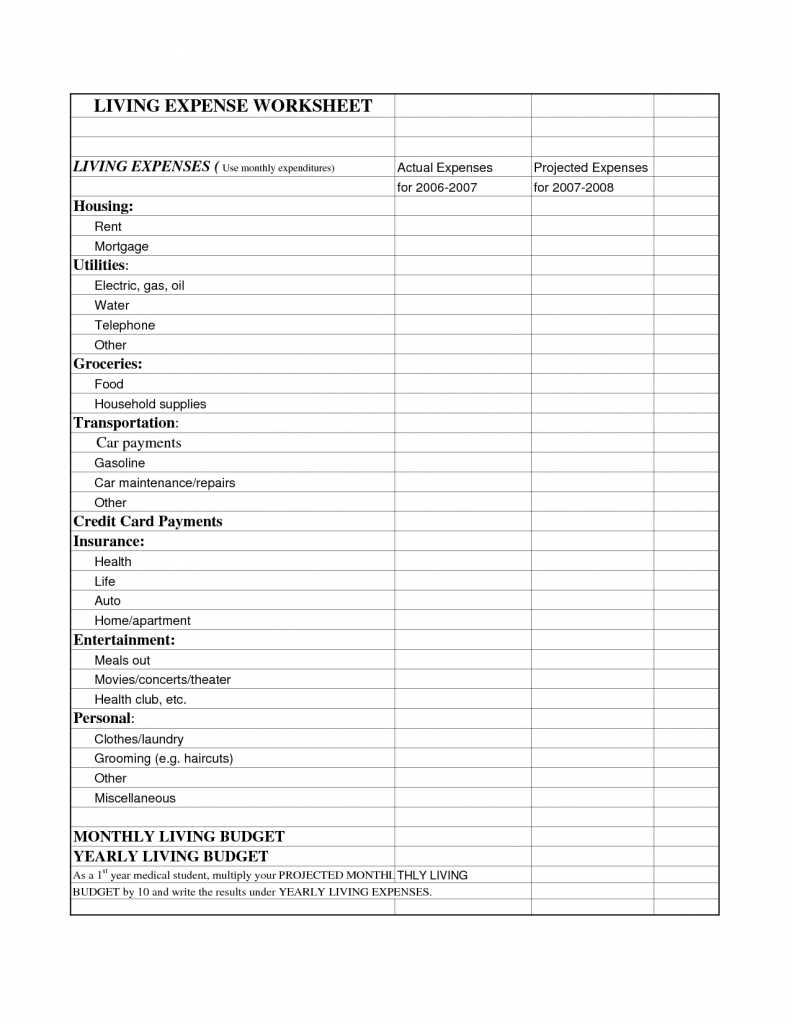

Read our guide on recommended budget percentages to see how much you should spend on each of these monthly payments. It’s possible to save money on all the expenses listed above.

0 kommentar(er)

0 kommentar(er)